May-June 2016 Europe Floods

Status: Closed

| Type of posting | Posting date(EST): | Summary | Downloads |

|---|---|---|---|

| Update 1 | 6/8/2016 2:15:00 PM |

|

|

| First Posting | 6/1/2016 3:15:00 PM |

|

Update 1 | Summary

Posting Date: June 8, 2016, 2:15:00 PM

A list of potentially affected postal codes in Belgium, France, and Germany is available for download on the ALERT website (login required).

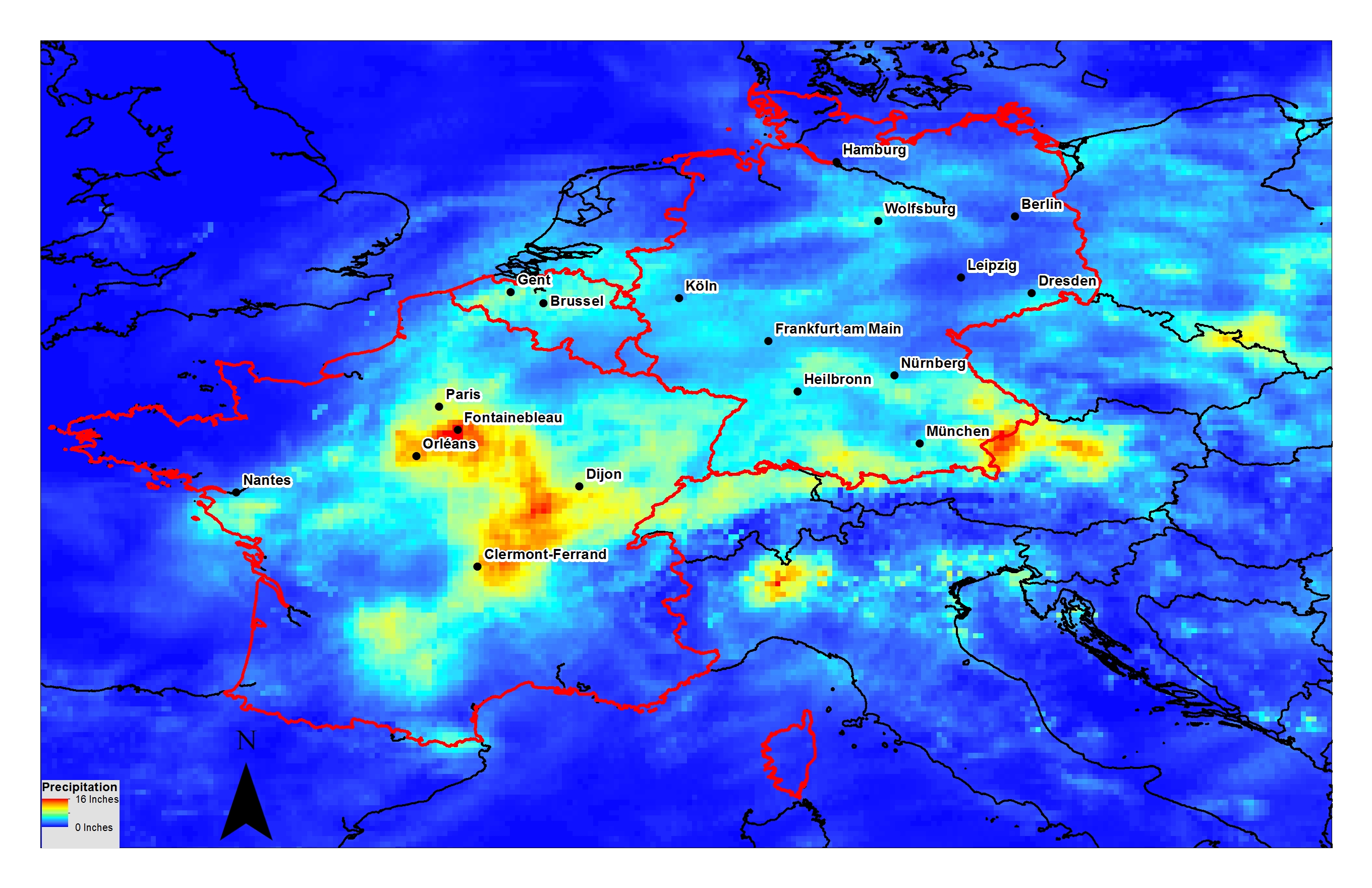

Between May 27 and June 7, widespread localized flooding—caused by slow moving thunderstorms with high precipitation associated with surface lows named Elvira and Friederike—has impacted communities in Belgium, north-central France, and Germany. As shown in the figure, some areas in central France received up to 16 inches of rain over the 10-day period ending June 5, amounting to as much as 60% of the average annual precipitation.

Significant precipitation occurred over many regions in Central and Eastern Europe during the 10-day period ending June 5, 2016. (Source: Preliminary estimates from the late run of the Global Precipitation Measurement Mission satellite observations, NASA, adapted by AIR Worldwide)

Thunderstorms Transform Creeks into Torrents in Germany and Belgium

Unlike the 2002 and 2013 floods, major rivers in Germany did not reach flood stage, but smaller rivers, such as the Kocher, Jagst, Ahr, and Wupper, as well as many small lesser-known creeks, went from below average to flood levels within hours. Many areas of Germany outside floodplains experienced flash flooding. Severe damage has been reported in the towns of Braunsbach, Schwäbisch Gmünd, Simbach am Inn, Triftern, and Tann. A total of 10 deaths have been reported as a result of the flooding in Germany alone.

In Belgium, northern Antwerp and the west of Flanders were hit with extensive flooding early this week, with waters rising in Limburg and Liege where several neighborhoods had to be evacuated. The Brussels-Limburg train service was suspended temporarily on the morning of June 2. One death has been reported as a result of the flooding in Belgium.

Localized floods were also reported in Austria, Poland, and the Netherlands.

The City of Lights Goes Dark

In France, the largest losses occurred in the Loiret region and along the Seine. According to France’s national weather service, Méteo France, Paris experienced its wettest May since 1873. Hardest hit last month were Paris and environs, the Loire Valley, and Picardy. In Paris the Seine overflowed its banks on Thursday, June 2, prompting President François Hollande to declare l’état de catastrophe naturelle or a “state of natural disaster” in Paris. In the Paris and Loiret regions more than 24,000 homes lost power, and several thousand of them are still without it. The flooding in Paris disrupted rail transportation, including some of the main commuter lines, compounding service interruption caused by strikes that had left only a fraction of France’s trains running when the flooding began. Tourist boat cruises were also halted, and roads leading into Paris and within the capital were flooded, which worsened travel conditions.

Both the Louvre museum and the Musée d’Orsay closed their doors to the public on Friday, June 3. The Louvre moved 150,000 artworks to safety and reopened on Wednesday, June 8, but the Musée d’Orsay has not set a date for reopening yet. At the same time the Grand Palais and two branches of the national library closed and have since reopened. The Seine crested at 6.1 meters (20 feet) above normal on Saturday June 4, the highest level since 1982 when it reached 6.18 meters, but short of the record level set in 1910 of 8.62 meters. However, 75 kilometers south of Paris, in Nemours, a commune that borders the department of Loiret, the waters of the Loing River, a tributary of the Seine, surpassed 1910 flood levels, causing 3,000 out of a total 13,000 inhabitants to be evacuated. Hundreds of towns and villages were hit by the flooding in France, with many in central France experiencing the worst flooding since 1910 causing about 2,000 to be evacuated across the area, in addition to the 3,000 in Nemours. Four deaths have been reported as a result of flooding in France.

Insurance Impacts

Of all natural hazards that cause property damage in Europe, flood is the most costly. Flooding is a regular occurrence—one not limited to the coast or low-lying river valleys, but nearly ubiquitous due to off-floodplain flash flooding. AIR expects much of the loss from this event to occur outside of the floodplains. Smaller claims from off-floodplain losses can add up to a significant portion of total insurance losses.

In France, flood is covered through direct insurance which can then be ceded to reinsurers. CCR (Caisse Centrale de Réassurance) is the state backed reinsurer, and insurance companies can choose to cede to CCR either via quota share or stop loss reinsurance. Insurers can choose their reinsurer. Only CCR is backed by the state. In general, about half of flood losses are paid by CCR, although this ratio depends on how much of the flood loss is ceded to CCR for a given event. The take-up rate for flood in France is close to 100% (with the exception of the automobile line of business). Typical deductibles for direct flood damage in France are €380 for residential and 10% with a minimum of €1,140 for commercial properties, with a three-day minimum €1,140 deductible for operating losses.

The average flood insurance take-up rate for residential buildings across Germany is estimated at around 38%. However, there are significant regional differences in insurance. For example, in Baden-Württemberg, most building policies include flood coverage and therefore the flood protection take-up rate there is 95%, whereas in neighboring Bavaria it is only 27%.

In Belgium, flood is covered by direct insurance and is guaranteed to be covered under “simple risk” fire policies. Risks located in high-risk zones or those which demand a high rate in the regular insurance market can be covered by rates set by the Tariff Office and ceded to the Belgian natural catastrophe pool (Canara). All insurers that write simple risk fire policies must contribute to Canara in proportion to their market share. In the eventuality that a flood event loss exceeds the limits of the direct insurers and their reinsurers, and the government declares the event to be a “public catastrophe,” a government Disaster Fund (Caisse Nationale des Calamités) will cover the surplus, albeit up to a limit of €280 million. Deductibles for simple risk policies are regulated by the state and cannot exceed €610 (based on the consumer price index in 1983), but are typically around €215 based on the current index rate. Take-up rates in Belgium are very high for residential risks, but can be lower for commercial and industrial risks.